More farmers jumped off the hemp bandwagon for a second consecutive year, causing a dramatic drop in acres dedicated to growing the crop in 2021.

This decline follows the production boom in 2019 that outpaced consumer demand and filled storage barns across the U.S.

Continued uncertainty about federal regulations on hemp-derived CBD, an immature supply chain, risky farming conditions in a record drought year, low wholesale prices and a surplus of leftover flower and biomass from past seasons were all factors that played into a significant reduction of hemp acreage this year.

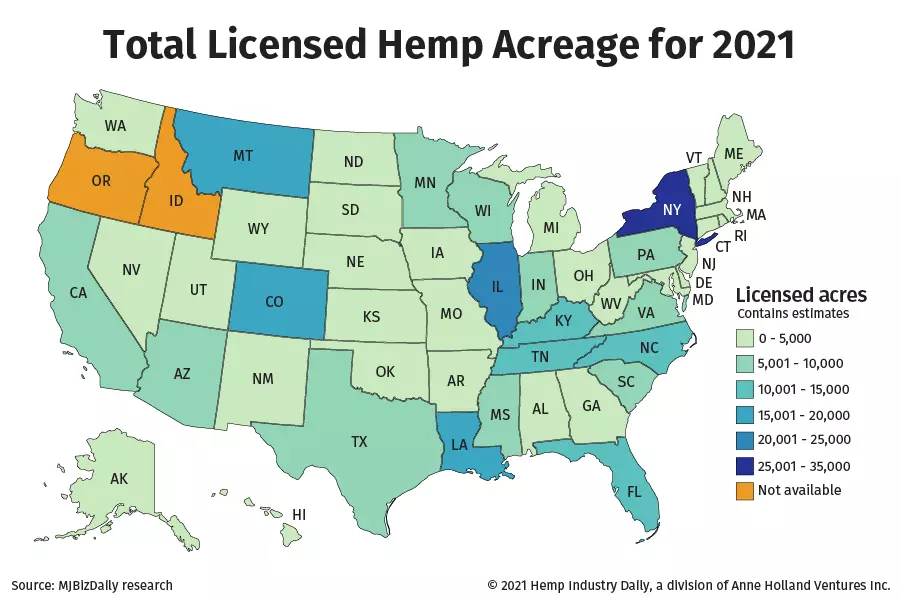

As of late September, U.S. producers licensed an estimated 284,793 acres in 2021.

Hemp Industry Daily estimates are based on data provided by the individual states and the planting report from the USDA Farm Service Agency.

The data reflects:

- A 24% decrease from the 375,000 licensed acres reported to the U.S. Department of Agriculture’s Farm Service Agency in 2020.

- A 39% decrease from the 465,787 total licensed acres of hemp across 47 states that reported to Hemp Industry Daily in June 2020.

In just two years, licensed hemp acreage plummeted 44% compared to 511,442 total licensed acres of hemp across 34 states in 2019, a record production year following legalization of hemp as a federally legal commodity crop with the 2018 Farm Bill.

That number was more than quadruple the number of acres licensed in 2018, according to industry advocacy group Vote Hemp.

Not unexpected

Hemp industry leaders expected a production decrease in 2021, in part because prices haven’t rebounded significantly after farmers were faced with a glut of product and minimal sales outlets after the 2019 season.

Many blame a lack of regulation from the U.S. Food and Drug Administration for stifling the industry’s growth, saying the lack of regulation has made large national consumer product goods companies steer clear of the CBD market.

While hemp leaders are enthusiastic that legislation could force the FDA’s hand to regulate hemp-derived CBD as an ingredient, the industry needs to lobby for changes to federal law and gather safety data to convince the agency to regulate CBD, said Emily Leongini, an FDA attorney and partner with Arent Fox in Los Angeles.

“We’re still going to go back to that safety concern because FDA is going to be involved with crafting that legislation,” Leongini told Hemp Industry Daily.

“Any time a bill is introduced and they send it over to FDA to get their technical assistance on it, FDA is not going to go along with a proposal that, from its perspective, introduces potential for consumer risk and harm, so still there’s that safety concern that needs to be addressed.”

Other hemp insiders projected that the focus would shift from producing hemp for flower to fiber and grain varieties; however, hemp produced agronomically requires more acreage than varieties produced for cannabinoids, not less.

While the industry is seeing farmers’ interest pivot to fiber varieties as efforts ramp up to capitalize on the purported environmental benefits of the plant, until a healthy supply chain is developed, many growers won’t ramp up production significantly, according to Rusty Peterson, a Michigan hemp producer.

A safer bet at this point would be growing hemp for grain because a market already exists, and food manufacturers are seeing increased interest driven by consumers demanding plant-based protein, according to Wendy Mosher, CEO of New West Genetics in Fort Collins, Colorado.

“With approval for feed, it could be up to 22 million acres, and that’s because it’s such an interesting nutrition profile that’s pulling from canola, it’s pulling from some corn for rotation and also from soy and the smaller flax, sunflower.”

But Mosher said she is already seeing astronomical demand for fiber genetics for the 2022 season.

“We’re seeing the swing from CBD to fiber, and I love the (fiber) applications. I think it has amazing potential, but it’s not here yet,” Mosher told Hemp Industry Daily.

“I’ve heard close to 100,000 acres in fiber next year. People are asking me for seed already.”

Hemp by the numbers

Many states have eliminated tracking of outdoor versus indoor production. However, of the states that separate the cultivation methods, licensed indoor production adds up to 27.6 million square feet or 635 acres, down from 93.6 million square feet or 2,150 acres of tracked indoor production as of June 2020.

In 2021, states and territories licensed 9,211 hemp producers, a significant decrease from 2020. Last year, the United States set a record with roughly 20,000 hemp cultivation licenses issued across the country, up from nearly 17,000 in 2019.

Currently there are three states – Hawaii, Mississippi and New Hampshire – that have eliminated their state-run programs, instead having growers produce under the USDA’s hemp production program.

An agency spokesman told Hemp Industry Daily that the USDA has issued nearly 500 licenses for those states.

USDA also oversees nine production licenses for four American Indian tribes in 2021.

More states will operate under the USDA program in 2022, including North Carolina and Wisconsin.

Not all states require processor licenses, but those that do granted 1,966 processor-handler licenses in 2021. Because of the inconsistent requirements and tracking, it is likely that the U.S. has more processing capacity available than reported.

Leading hemp states

Even the top-producing hemp states since the crop was brought back under the pilot program through the 2014 Farm Bill have seen a major falloff in hemp interest among farmers.

| Outdoor (acres) | Indoor (square feet) | Growers | ||||

| State | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 |

| Colorado | 36,225 | 19,707 | 11.4 million | 7.9 million | 1,254 | 564 |

| Arizona | 34,000 | 14,790 | 1.5 million | 1.3 million | 157 | 82 |

| California | 17,184 | 5,243 | n/a | n/a | 479 | 257 |

| Kentucky | 32,000 | 12,000 | n/a | n/a | 970 | 450 |

| New York | 32,481 | 32,777 | 9 million | 11.2 million | 717 | 748 |

| Oregon | 27,434 | 3,800 | n/a | n/a | 1,449 | 780 |

| Illinois | 26,264 | 22,961 | n/a | n/a | 770 | 647 |

| North Carolina | 14,562 | 14,200 | 7.1 million | 6.8 million | 1,525 | 1,500 |

| Florida | 22,000 | 12,000* | n/a | n/a | 705 | 732 |

| Michigan | 2,830 | 2,859* | 1.3 million | n/a | 636 | 163 |

| * Estimated acreage N/A is used to indicate states that do not separate licensed indoor space from outdoor. |

||||||

New York now leads in production, with minimal year-over-year difference in outdoor acreage and an additional 2 million square feet in indoor production for 2021.

Illinois hemp production licensing is fairly status quo year-over-year, compared with other states this year.

Meanwhile Oregon, which has been a top-producing hemp state since 2014, declined to provide information beyond its initial licensing numbers in April, which accounted for just 3,800 acres.

Beyond last year’s top 10, Minnesota has 2,000 fewer outdoor licensed acres – 6,099 compared to 8,367 in 2020 – but its indoor acreage has more than doubled this year, from 1.3 million square feet of production to 2.9 million square feet.

Licensed versus planted

The number of acres planted has equated to roughly a third of the land licensed in past years, and even less ends up harvested. In 2020, the USDA estimated 105,600 acres were planted and 74,000 were harvested.

In 2019, farmers ultimately planted roughly 230,000 acres and harvested closer to 115,000 acres, according to Vote Hemp.

Spot pricing platform Hemp Benchmarks estimates the hemp industry will see just over 40,000 acres planted in 2021, based on data from USDA and state agriculture departments.

However, planted acreage estimates from USDA’s Farm Service Agency can exceed actual planted acres because the agency must count acres that are replanted due to weather and other issues during the season.

The hemp industry is hopeful that there will be more consistent and reliable data coming after this year, following an announcement from USDA that its National Agricultural Statistics Service is surveying hemp producers this month.

On Oct. 18, USDA-NASS will mail its first Hemp Acreage and Production Survey, which will collect data on both indoor and outdoor producers to provide hemp production benchmarks for growers, regulators and the industry.

Producers can complete the survey online or complete and return the survey via mail by Dec. 10.

Laura Drotleff can be reached at [email protected]