Even in the relatively new competitive market around CBD, consumers are turning to trusted companies and brands to acquire products with the cannabinoid.

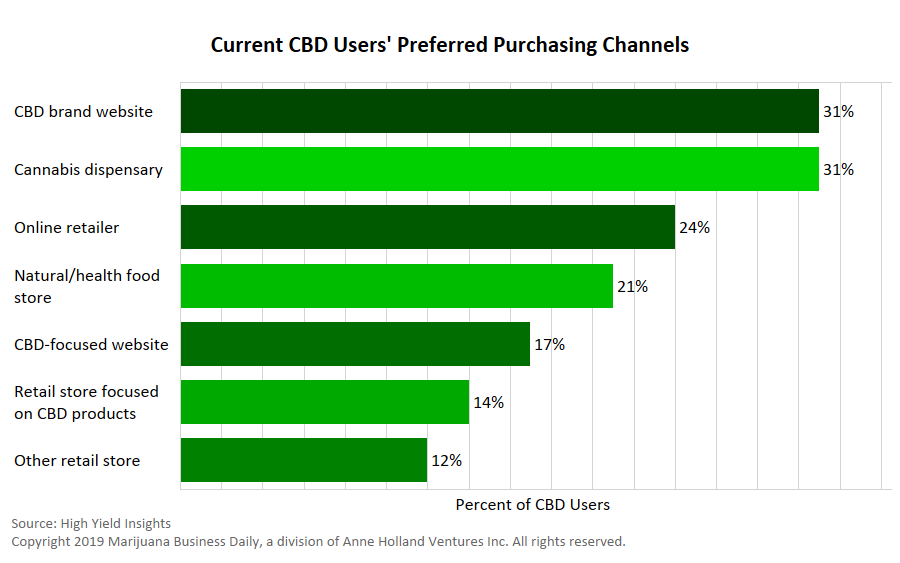

Nearly one-third of respondents to a survey from High Yield Insights said they purchase CBD products from a specific brand’s website – more than those who said they use a general online retailer and nearly twice the number who said they would use a general CBD-focused website.

High Yield Insights, a Chicago-based, cannabis-focused consumer insight and market intelligence firm, conducted the online survey of 2,000 consumers 21 and older across the United States in January.

The report’s authors highlighted that most of the consumers surveyed were using CBD to treat health and wellness issues such as depression, chronic joint pain or arthritis, chronic muscle pain and insomnia.

Those health- and wellness-focused CBD users want to feel the same level of trust with CBD brands that they have for CPG brands they are used to having in their household or seeing on store shelves.

This level of brand recognition and value should bode well for mainstream health-focused retailers who have entered the market for CBD products, hoping to capture a piece of a market that may exceed $1 billion in sales this year.

To date, this includes health-based retailers CVS, Rite Aid, The Vitamin Shoppe and Walgreens.

Here’s what else you need to know about the situation:

- Seventy-five percent of the survey group identified themselves as current users of CBD – defined as someone who uses CBD regularly or at least once within the previous three months.

- Just over half of CBD users surveyed are new to the party, having used CBD for one year or less.

- Preferred intake methods varied by age group, with consumers 21-34 years old preferring vape pens and those 35-44 preferring infused chocolate edibles. CBD users age 45-54 preferred to use topicals, while tinctures are preferred by consumers 55 and older.

- Among nonusers, barriers to CBD adoption were identified as cost, preference for the “head high” of THC, skepticism about CBD’s efficacy and ingredients and dislike of the available products.

Maggie Cowee can be reached at [email protected]