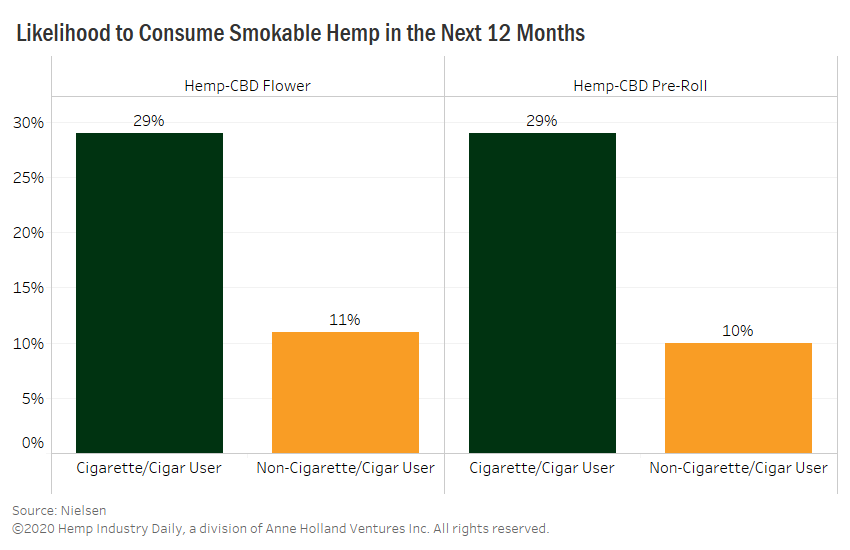

Entrepreneurs in the smokable hemp sector have reason to hope that tobacco consumers may convert at least partially to hemp products within the next year.

That’s because 29% of cigarette and cigar users have indicated they are willing to try these products, according to research by Nielsen Global Connect, which was highlighted in Hemp Industry Daily’s report, “Sector Snapshot: Opportunities & Challenges in Smokable Hemp.”

Nielsen noted that nearly 1-in-4 cigarette or cigar smokers claim to have consumed a hemp-CBD product (24%) or e-cig or non-cannabis vape product (24%) over the past year. That compares to the aggregate of U.S. adults, of whom fewer than 18% have ever consumed hemp-CBD.

More specifically, 10% of tobacco cigarette/cigar smokers said they have used a hemp-CBD pre-roll or smokable flower in the past month, 8% have used a hemp-CBD pre-roll and 9% have used smokable flower.

Compared to the total U.S. adult population, cigarette and cigar smokers are 35% more likely to have ever consumed a hemp-CBD product and 157% more likely to have consumed a smokable hemp pre-roll or flower product.

Hemp-CBD pre-rolls are more popular among tobacco users, considering that these consumers are 191% more likely to have consumed pre-rolls and 155% more likely to have consumed hemp-CBD flower in the past month.

Compared to nonsmokers, consumers who currently smoke cigarettes or cigars are 164% more likely to consume hemp-CBD flower in the next year, while 195% of smokers are more likely to consume hemp-CBD pre-roll products.

Comparing current spending

According to CannaUse, a syndicated cannabis study released in early 2020 by Nielsen, 15.8% of U.S. adults (21 or older) said they use cigarettes and 9.3% consider themselves “regular” cigarette users.

Another 11.4% said they use non-cannabis e-cigarettes or vapes, and 6% consider themselves “regular” users of these products.

Consumers’ average yearly purchases of smokable-hemp product is currently 10% of the average annual U.S. household spend for tobacco products.

While the heaviest users of hemp-CBD lay out $300 annually, the least frequent users spend closer to $44 per year. On average, hemp-CBD consumers spend roughly $88 per year on smokable-hemp products.

Comparatively, consumers of smokable-hemp products outspend users of loose-pipe tobacco, who spend an average $63 annually, and loose-cigarette tobacco, who spend $84 per year. Meanwhile, average households spend $101 per year on cigars and more than five times that, approximately $546 annually, on cigarettes.

Get more insights about the smokable hemp sector by downloading the report here.

Laura Drotleff can be reached at [email protected]