While delta-8 THC is certainly stealing the spotlight, CBN might just be the sleeper cannabinoid of the summer – pun intended.

Over the past year, cannabis companies have been leveraging the compound’s reputation as a sleep aid with growing success.

Also known as cannabinol, CBN was first discovered nearly a century ago.

Over that period, companies have done little with CBN, given the time-consuming process of producing the cannabinoid.

But that is now changing, thanks to the development of new production methods.

And demand is climbing.

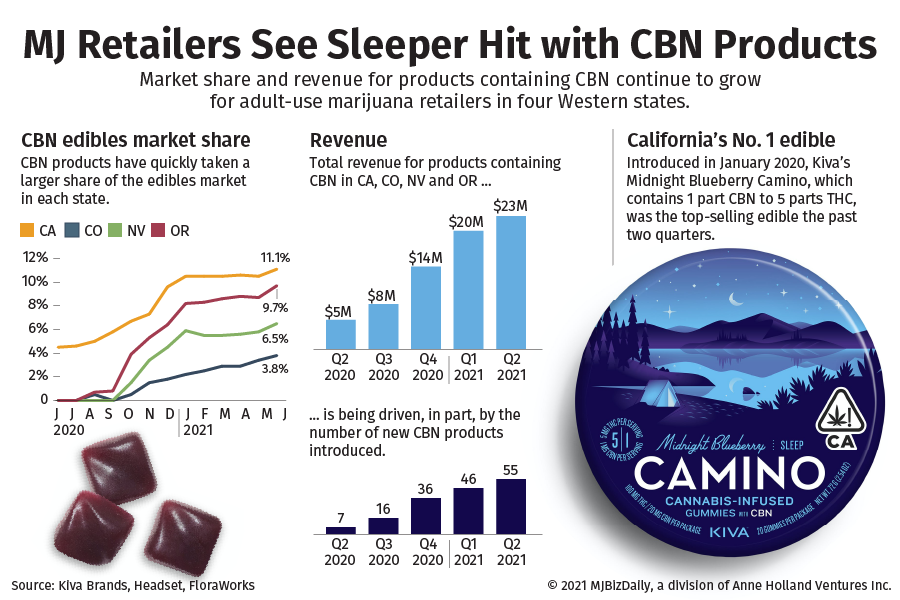

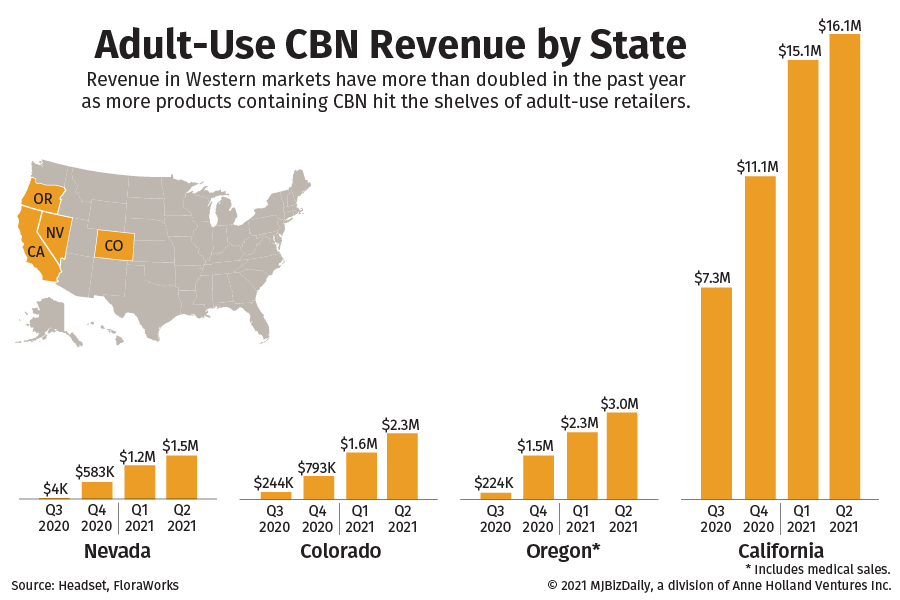

Sales of products containing CBN – almost entirely edibles, at this point – totaled more than $65 million in the past four quarters for adult-use retailers in California, Colorado, Nevada and Oregon, according to data provided by Seattle-based data-analytics firm Headset and FloraWorks, an Oregon supplier of hemp-derived cannabinoids such as CBN.

It should be no surprise California had the largest revenue of the four markets.

CBN products provided $16.1 million in sales for the second quarter of this year in the state, up 6.6% from the previous quarter and 120% from the third quarter of 2020.

And more brands are entering those markets weekly.

There were only seven CBN products in those combined states a year ago, but that number grew to 55 in the second quarter of 2021, up 20% from the first three months of the year.

Also, CBN edibles are taking a larger share of that market.

Edibles containing the cannabinoid accounted for 11% of California edible sales in June, up 6.5 percentage points from 2020.

That trend has carried through in other states.

Sales of CBN edibles in Oregon, Nevada and Colorado were almost nonexistent in June and July 2020, but they ended June 2021 at 9.7%, 6.5% and 3.8%, respectively, as a percentage of each state’s edibles market.

California-based edibles company Kiva Brands, an early CBN adopter, is riding the wave of early growth.

Introduced in January 2020, Kiva Brands’ Camino Midnight Blueberry gummies, which contain 1 part CBN to 5 parts THC, have been the top-selling edible in California for the past two quarters.

Some believe CBN’s sedative effects can be amplified when paired with THC.

Many of the regulated CBN products contain this hybrid or ratio model, providing a small portion of CBN paired with some amount of THC – such as Camino’s 5-to-1 proportion.

Kristi Palmer, Kiva’s co-founder and head of business development, said the company came upon this formulation after lots of research and testing, which showed the beneficial effect involving this particular ratio.

“We’re doing as much research as we can on the back end to make sure it’s the right path to go down,” she said.

“You use a lot of data to make those decisions, but there’s nothing quite like seeing the sales and seeing the traction take place.”

And with the success of the gummies, Kiva has added CBN to its other THC lines, including cookies, mints and chocolate bars.

Palmer also attributes the company’s success to purposeful marketing and educational outreach to retailers.

A Kiva Brands retail display highlighting its CBN products. (Photo courtesy of Kiva Brands)

The company created an in-store display of its various CBN products to not only help consumers associate the products with sleep but also to help retailers sell them.

Sampling was big, too.

For the launch of its Terra Milk and Cookies THC/CBN product, Palmer said Kiva put the product in a tiny tea mug and wrapped that up with a little sleeping eye mask.

“Budtenders and buyers need to see it and understand it,” she said.

A long history

With all the sudden growth, it’s hard to believe that CBN has been around for more than 90 years.

CBN was discovered in the 1930s and then, in the 1940s, became the first cannabinoid to be isolated.

And while it provides a mild psychotropic effect, up until recently not much has been done with it.

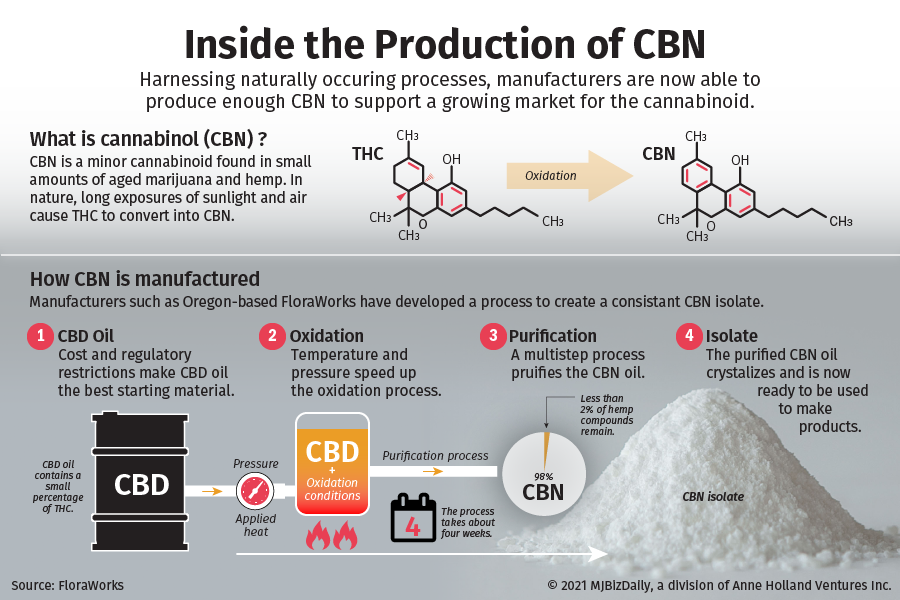

Unlike CBD, CBN is hard to make.

Little to no CBN is created or contained in new or fresh cannabis plants.

The cannabinoid is produced when marijuana or hemp plants are exposed over long periods of time to air and sunlight.

As the cannabis dries and ages, an oxidation process turns the THC molecules found in marijuana and hemp into CBN.

Yet, until now, the time involved to produce consistent CBN naturally hasn’t been practical.

It took a growing sleep-aid market and tales of the sedative nature of smoking old marijuana to get the industry to rethink CBN.

Although there are varying numbers, the U.S. sleep-aid market was expected to be about $31 billion in 2020, according to Maryland-headquartered Marketdata.

The sleep aid that’s most comparable to CBN, melatonin, is expected to reach $2.4 billion in sales by 2025.

Those numbers alone have been much of the incentive for cannabis companies to position themselves to get a slice of the sleep market.

Speeding up the process

A growing number of companies are taking on the difficult problem of making and scaling CBN as an ingredient.

Cannabinoid manufacturers such as FloraWorks have developed extraction processes that not only speed up the natural oxidation process of CBN creation but also purify the cannabinoid to provide a consistent isolate for product manufacturers.

Because CBN is derived from THC, both marijuana and hemp can be used to make it.

Obviously, using marijuana in the process is more effective due to the higher amounts of THC in the plant.

But cost and a complicated regulatory market make hemp-derived CBN a suitable base material even if there is much less THC in the plant.

For this reason, FloraWorks uses crude CBD oil as a starting material.

Alleh Lindquist, the company’s chief strategy officer, said FloraWorks is focused on scaling.

The company is producing 100 kilograms (220 pounds) a month of CBN isolate and is working to expand that to 1,000 kilograms as demand grows.

The company is hoping that CBN ultimately will become a dietary ingredient, as melatonin has, and recently started the process to seek approval from the U.S. Food and Drug Administration for such a designation.

“Those issues to us had to be solved for this to become a large-scale product that you could eventually buy in a CVS alongside melatonin,” Lindquist said.

But Lindquist said that CBD companies have been a hard sell because they don’t seem interested in telling consumers that CBN might be better for sleep than CBD.

“We have noticed just a tad bit of hesitancy in that space,” he said, “because it’s almost contradictory of the story they’ve been peddling.”

Lindquist suspects a huge education effort will be needed, much like the one that took place in the early days of CBD.

The company hopes things will change and will continue to push for CBN to become a sleep aid commodity like melatonin.

Meanwhile, the supply-demand situation is changing. As more companies begin manufacturing, CBN prices are dropping.

Lindquist said the company’s first kilograms – produced in June 2020 – sold for $10,000 each. The price has since fallen to $5,000.

The open market

One company that is taking a different tact is California-based Sandland, which purchases CBN from FloraWorks.

A subsidiary of the private equity group Gotham Green Partners, Sandland calls itself a sleep company.

“We are not a CBD or cannabis company per se or a wellness company in that regard,” said Ryan Savage, the company’s chief revenue officer.

“We are very specific to the vertical that we are in. Our brand is all about sleep and giving your body restorative, meaningful sleep.”

(Images courtesy of Sandland)

Sandland launched its first products in the first week of April:

- A sublingual tablet marketed as a fast-acting natural sleep aid.

- An extended-release pill formulated to provide a long-lasting sleep.

And while CBN is driving Sandland sales, consumers won’t see it splashed across their packaging or included in the product marketing.

Savage said that decision was intentional, as the rules for online marketing and advertising on platforms such as Google and Facebook can be a tough avenue to navigate when talking about hemp, CBD or CBN.

“We kind of played the game to see where we could go and what we could say, and we’ve narrowed it down to where we are, which I wouldn’t say is hiding CBN. But it’s a little bit of a shell game in the way of advertising that you have to be very cautious,” he said.

Savage also believes that people just want a product that works.

“Do you care that CBN is an ingredient? There is zero THC, it’s completely safe for consumption, so there is no real reason for us to jump out and say CBN.”

And hiding the CBN is also helping the company in other markets.

Savage said the brand has been well received by major national retailers that have similar concerns about regulations and labeling. The largest challenge, he said, has been educating those retailers on the difference between CBD and CBN.

And in a big win, the company recently was approved to sell on Amazon.

Savage said Sandland didn’t create the product with Amazon in mind. But because CBN has never been listed as a Schedule 1 drug, it is not prohibited by the e-commerce giant.

Sandland is selling online in the U.S. and is carried by some regional independent health food stores such as Mother’s Market, which has 11 stores in Southern California.

The company is also producing a marijuana-derived CBN product that is available in 50 stores in the California recreational market.

Savage sees this as giving those consumers a choice.

“There’s a large number of consumers that go in and buy THC/CBN gummies to help them sleep and they would prefer not to have THC, but there’s really nothing in the market that allows them to do that.”

Andrew Long can be reached at [email protected].